aurora sales tax rate 2021

An alternative sales tax rate of 675 applies in the tax region Centennial which appertains to zip code 80046. Sellers use our guide to keep current on all nexus laws and the collection of sales tax.

Illinois Car Sales Tax Countryside Autobarn Volkswagen

The latest sales tax rate for Aurora OR.

. The current total local sales tax rate in Aurora CO is 8000. 2021 COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Aurora Sales Tax Rates for 2022. The December 2020 total local sales tax rate was also 8000. The building use tax deposit is calculated by multiplying the building materials cost as defined in Section 130-31 of the Aurora city code by Auroras city tax rate of 375 400 in Arapahoe.

The Aurora Utah sales tax is 630 consisting of 470 Utah state sales tax and 160 Aurora local sales taxesThe local sales tax consists of a 150 county sales tax and a 010 city. Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2. Method to calculate Aurora sales tax in 2021.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Choose Avalara sales tax rate tables by state or look up individual rates by address. What is the sales tax rate in Aurora Illinois.

0375 lower than the maximum sales tax in MO. The 9225 sales tax rate in Aurora consists of 4225 Missouri state sales tax 25 Lawrence County sales tax and 25 Aurora tax. The minimum combined 2022 sales tax rate for Aurora North Carolina is.

Complete Edit or Print Tax Forms Instantly. What is the sales tax rate in Aurora North Carolina. Higher sales tax than 76 of Illinois localities.

This is the total of state county and city sales tax rates. Retailers are required to collect the Aurora sales tax rate of 375 on. Note that the State of Colorado has enacted the same clarification.

0875 lower than the maximum sales tax in NY. Ad There are currently more than 12000 state local tax jurisdictions across the 50 states. The minimum combined 2022 sales tax rate for Aurora Illinois is.

Choose Avalara sales tax rate tables by state or look up individual rates by address. The current total local sales tax rate in Aurora MO is 8850. This is the total of state county and city sales tax rates.

The 825 sales tax rate in Aurora. Aurora co sales tax 2021. Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator.

This rate includes any state county city and local sales taxes. There is no applicable city tax or. 2020 rates included for use while preparing your income tax deduction.

The minimum combined 2022 sales tax rate for Aurora Colorado is. Aurora-RTD 290 100 010 025 375. The December 2020 total local sales tax rate was 8350.

Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL. How does the Aurora sales tax compare to the rest of IL.

What is the sales tax rate in Aurora Colorado. Since the retailers sales in colorado in the current year exceed 100000 the retailer will be. The Aurora Illinois sales tax is 825 consisting of 625 Illinois state sales tax and 200 Aurora local sales taxesThe local sales tax consists of a 125 city sales tax and a 075.

The 8 sales tax rate in Aurora consists of 4 New York state sales tax and 4 Cayuga County sales tax. Ad Access Tax Forms. This is the total of state county and city sales tax rates.

The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city. 275 lower than the maximum sales tax in IL. This clarification is effective on June 1 2021.

An alternative sales tax rate of 881 applies in the tax region Denver which. The colorado co state sales tax rate is currently 29.

2021 Election Guide Meet The Aurora City Council Candidates Colorado Newsline

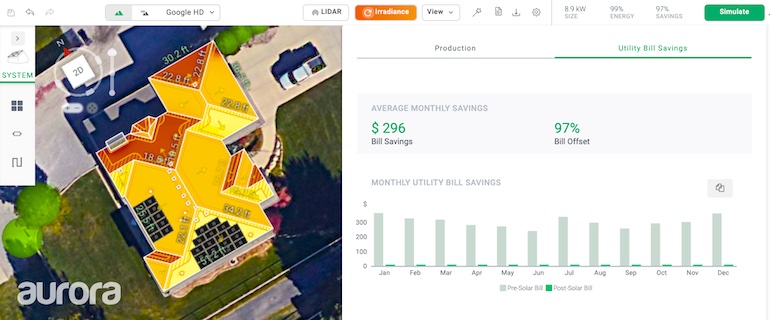

Guide To Business Management Software For Solar Contractors

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Disney Princess Aurora Ballet Doll 11 1 2 New 2021 Ebay

How To Look Up Location Codes Tax Rates Department Of Revenue Taxation

Colorado Homeowners Hit With Sticker Shock Over Property Valuations Have Until End Of May To Protest

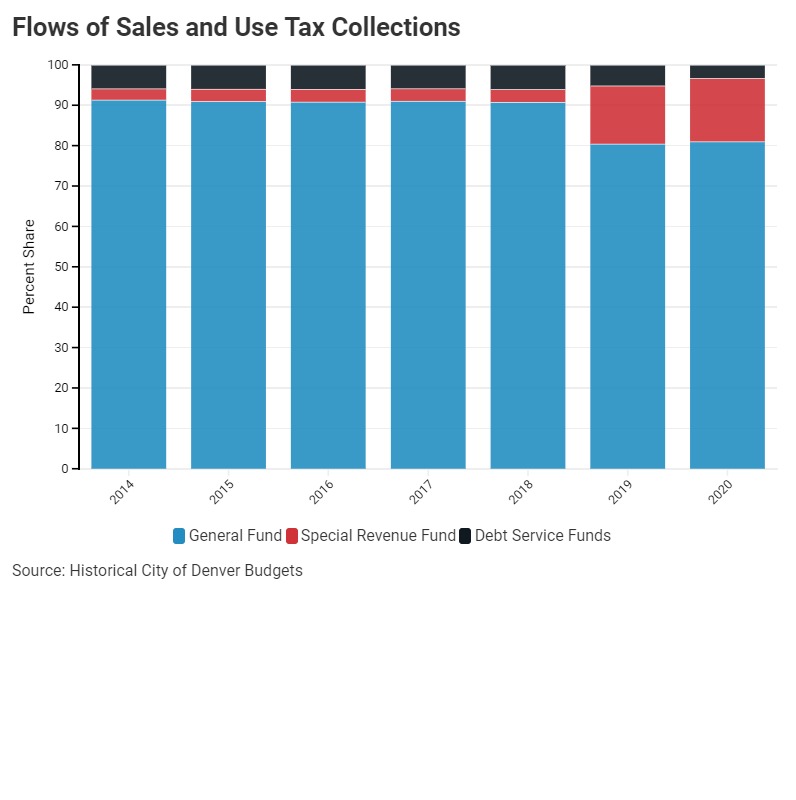

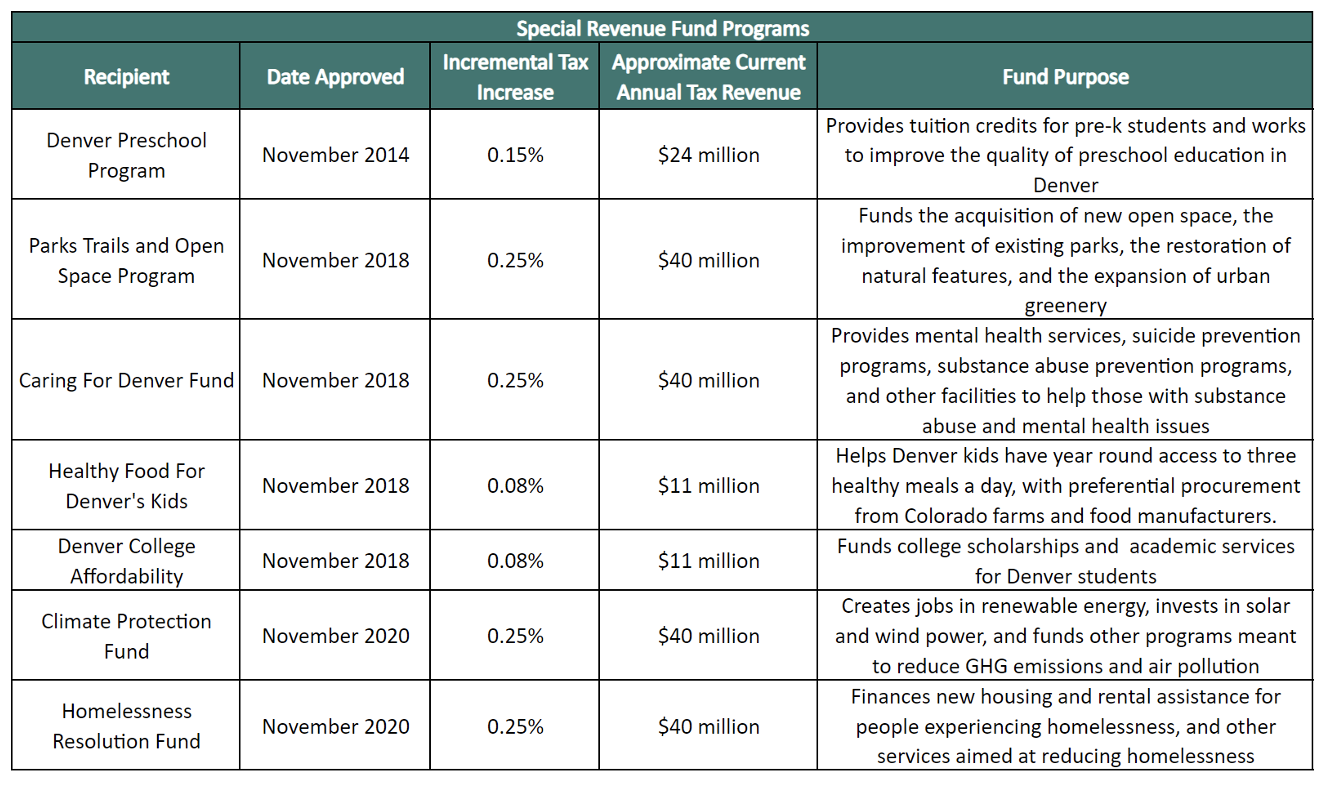

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

State Sales Tax Rates And Combined Average City And County Rates Download Table

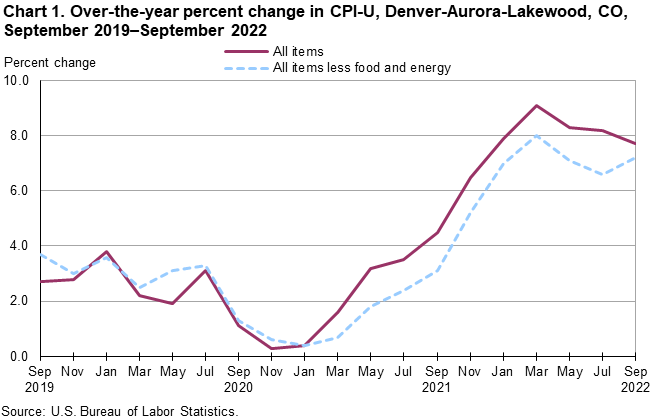

Consumer Price Index Denver Aurora Lakewood Area September 2022 Mountain Plains Information Office U S Bureau Of Labor Statistics

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Cities With Highest Sales Tax Sales Tax Rates By City Tax Foundation

Alienware Aurora Gaming Desktop With Amd Ryzen 5000 Series Dell Usa

North Aurora Home Sales In Week Ending Oct 8 Kane County Reporter

Proposed Village Budget Includes Tax Rate Increase East Aurora Advertiser

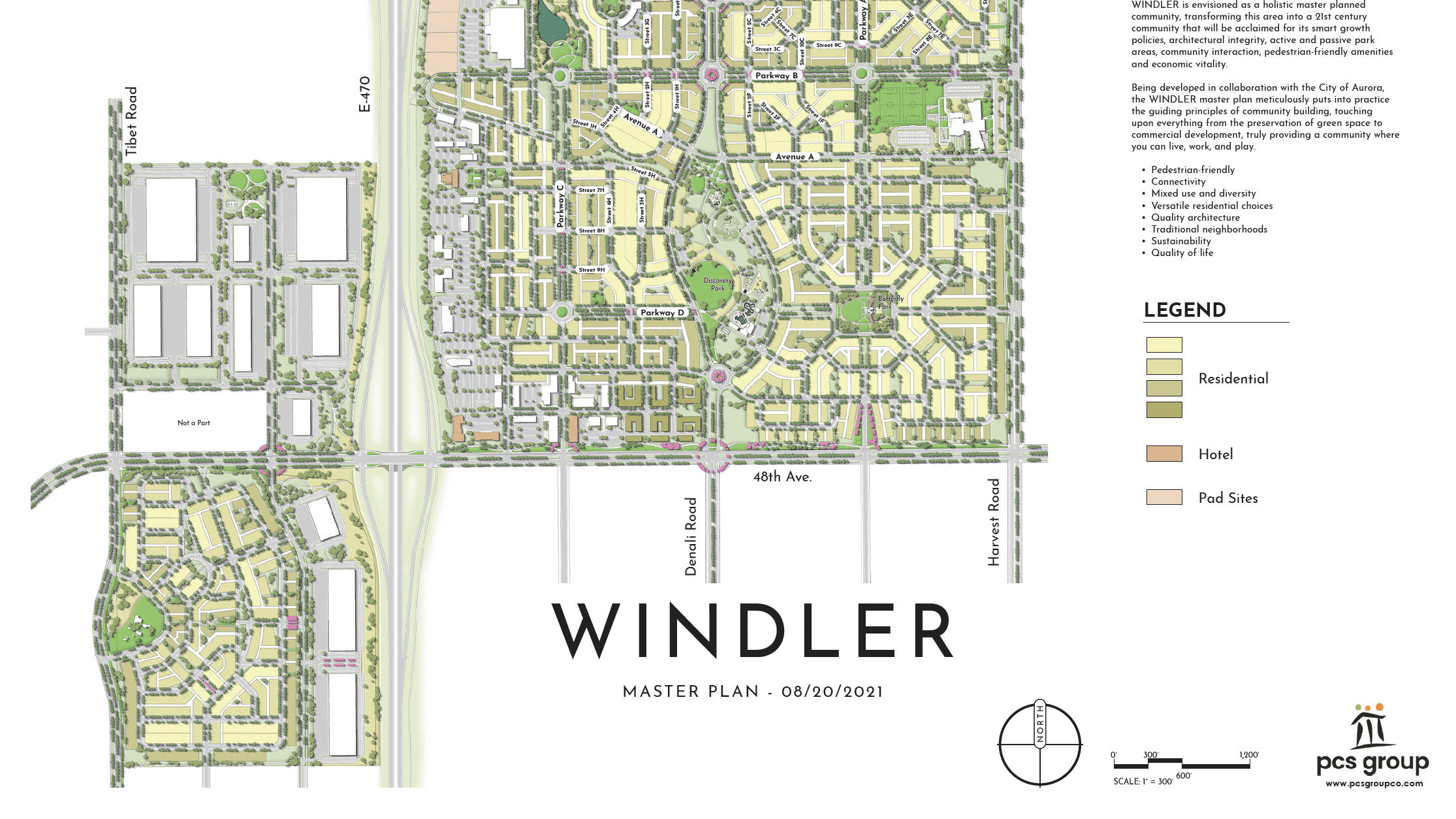

Aurora Highlands Residents Have No Vote Little Voice All The Debt Business Gazette Com